Can You Get Finance Under the Coronavirus Lockdown?

Australia joins other countries on lockdown, following the jump in coronavirus cases despite efforts to slow down the spread of infection through social distancing and awareness campaigns on hygiene and health. The measure is expected to further affect businesses after the serious economic disruption caused by the coronavirus outbreak in the country. Among the countless numbers of businesses that are affected are those in the financial sector.

Is getting finance during this uncertain time still possible? What should borrowers expect? Read on.

Coronavirus Lockdown in Australia

Following a meeting of the National Cabinet, Prime Minister Scott Morrison and Chief Medical Officer Professor Brendan Murphy had announced a partial-lockdown earlier this week.

The lockdown targets businesses that provide “non-essential” services—coffee shops, gyms, and clubs—which have remained frequented by locals despite the rise of coronavirus cases. Meanwhile, those that provide “essential services” and their suppliers will remain open. These include banks and office buildings.

The government did not provide a specific timeline for the lockdown but confirmed that the restrictions were in place until further notice and could be relaxed or tightened at any time.

However, a near-total "stage three" lockdown is reportedly on the horizon as the government struggles to contain the spread of coronavirus infection.

How Lockdown Affects Businesses and Lending

While the lockdown measure is expected to finally halt the spread of the deadly disease, it brings a tremendous negative impact on businesses as consumers are forced to stay at home and limit their outside trips to essential errands only.

- Some establishments have also shut down or suspended their business operations because of poor sales. Amidst these changes, many workers have been laid off or had their hours or wages reduced.

- While banks and lending businesses continue to operate, it’s not business as usual. The fear of infection and the limited outdoor trips have resulted in the dwindling number of borrowers who seek loans or search in the marketplace for homes or cars to buy.

This has fuelled banks and lending companies to take special loan rates and repayment holidays for borrowers.

Yes, You Can Get Finance Under the Lockdown

Because banks and offices continue to operate in Australia, it’s possible. Taking out a loan during this challenging time may even be favourable for you.

The nation’s leading financial institutions have provided a range of measures to support the economy and to help homeowners and businesses.

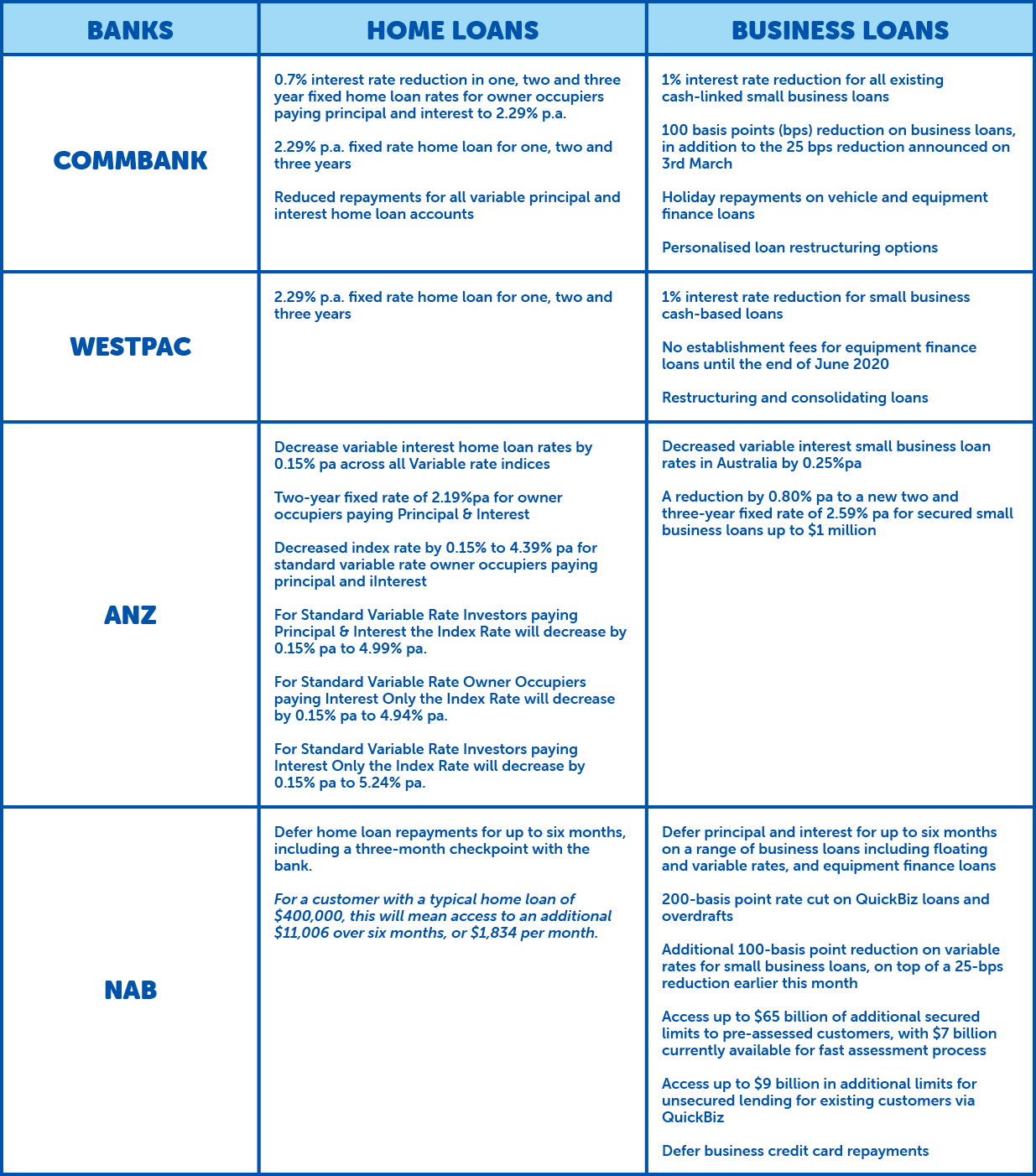

Here's a table of what the Big 4 are offering:

Source: startupdaily.net

Home Loan Repayment Holidays

Supposedly to help homeowners with active loans in these trying times, the Big 4 offer holiday repayments of up to six months under different conditions:

- Westpac offers a three-month holiday for borrowers who have specifically lost their job or suffered a loss of income. This can be extended to six months after a review.

- ANZ clients can defer their home loan repayments for up to six months but are subjected to a review at three months with interest capitalised.

- NAB offers the six-month holiday with a three-month checkpoint.

- Commbank offers the six-month repayment holiday for all borrowers who need it.

The Catch: Interest Capitalisation

The mortgage repayment holiday, while seemingly beneficial, is also risky. ANZ and Commbank, in particular, set an interest capitalisation on their offer.

Interest Capitalisation is the addition of unpaid interest to the outstanding loan balance. This means that as you postpone the repayments during the holiday period, your outstanding loan balance increases and your unpaid interest is capitalised.

In other words, once your repayment holiday is over, you will have to keep up with your repayments and your balance will be bigger than when you started the deferral process.

What’s In It For Me?

With the Big 4s’ reduced interest rates in home loans and small business loans, it may seem a smart move to take out financing during this time.

On the other hand, taking out a loan repayment holiday should be taken with caution, especially if it has a capitalised interest that increases your principal balance. Always weigh down your options, compare offers, and see to it that you can afford the repayments.

Positive Lending Solutions can help you find the right loan from our wide network of banks and lending partners across Australia. Call 1300 722 210 or fill out a Loan Pre-Approval form to apply.

See also:

$150k Instant Asset Write-off & How You Can Make The Most Of It

.png)

.png)