What Is the Difference Between Co-Borrowers And A Guarantor

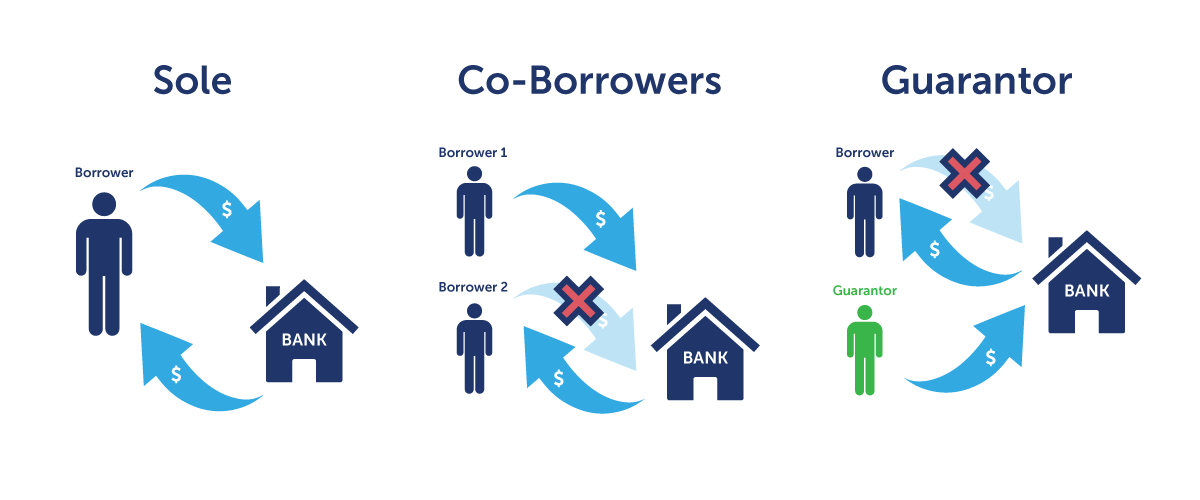

A loan application doesn’t necessarily involve only two persons: the lender and you as the borrower. In fact, you can apply for loan products in three ways:

- Single Borrower

- Co-Borrower

- With a Guarantor

This means that if you can help your mum, dad, sibling or partner get ahead with access to a loan product, you probably will. But what kind of obligation have you taken on, and what does this mean for you?

So why involve more than one person in the loan process?

Adding co-borrower or a guarantor can significantly increase the chance that the primary applicant will secure finance.

Before you go ahead with a loan, it is important that you understand the difference between the role of a co-borrower and a guarantor. You also need to understand the implications and possible consequences of adding a co-borrower or guarantor to your loan application and loan term.

We’ll explain all of this below.

What is a Co-Borrower?

A co-borrower is a direct borrower. This means that:

- Both borrowers have equal legal responsibility to repay the full amount of the loan, and

- The income of the co-borrower may be taken into account when the loan application is opened.

What does being a co-borrower mean for you?

- If the other person signing on the loan can not be pursued for payment, for example they go bankrupt, the lender can pursue the other borrower/s for the entire debt until it is paid in full.

- The lender is not obliged to pursue the first person for repayment of the loan - both co-signers are equally responsible and equally liable to make repayments on the loan.

- As co-borrower, you have entitlements over any property or assets purchased with the borrowed money.

- If re-payments aren’t made on time, the default will affect your credit score.

- Even if the person you have co-signed for does fully pay the loan, taking out a loan as a co-borrower can affect your ability to get finance in the future.

This is because a lender will consider your debt to income ratio. If your debts, including those you hold as co-borrower, are high, this could affect your ability to obtain finance.

If you are asked to be a co-borrower on a loan, one key question that you should consider is whether you stand to benefit from the loan.

For example, if the loan is for a car or a boat, will you get to use this vehicle as a driver or passenger? Is ownership of the vehicle necessary for your family, or will it add value to your weekends?

Why would you take out a loan with another person?

If you cannot afford to borrow the amount of money that you need by yourself, taking out a loan with a co-borrower or co-applicant can help you to qualify for the loan that you need. If the co-borrower also stands to benefit from the loan, they will be more likely to join the application with you.

For more information on being a co-borrower, read this fact sheet. You should always seek independent legal advice before signing a loan contract as a co-borrower.

Case Study: Jessie dreams about opening a restaurantJessie is passionate about cooking and food, and dreams of starting her own restaurant. Since completing her TAFE course 3 years ago she has worked hard as a chef at a local nursing home. This is a good, stable job, but preparing the same meals day after day isn’t fulfilling Jessie’s dreams of creating new and exciting tastes. Last month she discovered the perfect location to launch her own restaurant. When she visits her parents for the monthly family dinner, she outlines how she will decorate the interior, what the menu will look like, and how hard she has been working for this opportunity. Should Jessie’s dad help her secure a loan to launch her new business idea by acting as a co-borrower or guarantor? |

What is a Guarantor?

As a guarantor you are signatory to the loan. However, the lender will pursue you for payment in the event the primary borrower defaults on the loan.

A default on a loan is when the primary borrower fails to meet repayments when they are due. When a default first occurs most lending institutions will first request payment from the primary borrower.

If this is not forthcoming, and the primary borrower is unable to meet their repayment obligations, then the lender turns to the guarantor.

- The borrower has primary responsibility to pay the debt, and the guarantor has secondary responsibility for the debt.

- All responsibilities of the guarantor can be met without the loan being repaid in full, if the guaranteed amount is paid in the event of discharge of the loan.

- The amount of the guarantee may be between 20% and 100% of the full value of the loan.

- The guarantor only becomes liable to pay the amount of the guarantee when the financial lending company has proven that the borrower has defaulted on the loan.

- If the loan is for property or to start a business, the guarantor may be released from the loan once equity has been built up.

So when can having a guarantor help you to secure the right loan application?

A guarantor can help you get approved for a loan:

- When you can afford the loan repayments, but you don’t have enough deposit. This could help you to get into your own home sooner if you are are renting, as it means the amount you need to save for your deposit won’t be as high

- If you have a poor or limited credit history

If you want to use a guarantor to increase your borrowing potential, you must be able to make the payments for the entire loan on your own income.

| Co-borrower | Guarantor | |

|---|---|---|

| Am I responsible for loan repayments? | Yes | No |

| Do I have rights to the goods or property purchased with the loan? | Yes | No |

| In the event of default, am I solely responsible for repayment of the full amount of the loan? | Yes | The loan contract which you sign will specify whether you must pay a fixed amount or all outstanding money in the event of default on repayments. |

Returning To Our Case Study: Jessie dreams about opening a restaurantReturning to our case study above regarding Jessie and her Dad: If Dad decides to help Jessie to secure the money she needs to set up her own business, he should offer to act as a guarantor rather than as a co-borrower. This will not only protect him from financial consequences, it will also protect his relationship with Jessie if the new restaurant struggles. Once Jessie has built up equity in her new business, her Dad can be released as guarantor for the remainder of the loan. |

A Final Thought About Co-borrowers and Guarantors

When acting as a co-borrower or guarantor, consider and treat the loan as if you were taking out the loan yourself.

It is always important for both parties to a loan to seek independent legal and tax advice when making these types of decisions.

Ready to take out a loan with or without a guarantor? Kickstart your application by getting a Loan Pre-Approval or call us on 1300 722 210.

See also: