Getting a Car Loan With a Balloon Payment? Here’s What You Should Know

Are you in need of a new car but don’t have the money for the down payment? You might want to consider getting a car loan with a balloon payment.

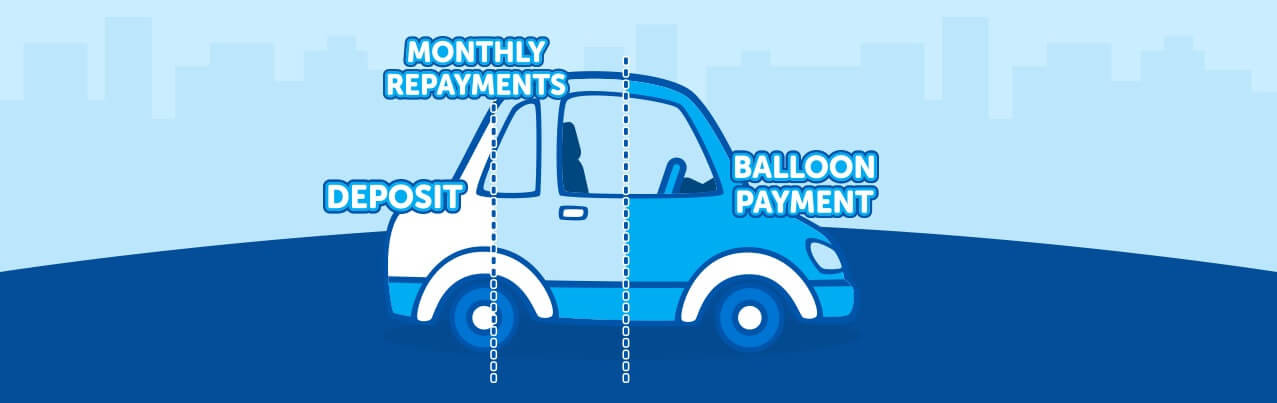

A balloon payment car loan is a type of auto financing where, instead of making a down payment to secure the loan, you pay a lump sum at the end of the term. This amount is significantly bigger than your monthly loan repayments to pay the principal of the loan.

Like other types of car financing, a balloon payment car loan has its benefits and disadvantages.

Advantages

1. It keeps your monthly payments low.

Since your balloon payment is scheduled at the end of your loan term, your monthly payments are reduced. This situation is very favourable if your income is low. It also works best if you’re starting a business that is currently not giving you enough ROI but is expected to make above-average returns in a year or two.

2. It buys you time to save for the balloon payment.

Paying the lump sum at the end of the loan term gives you enough time to raise the money. It also helps you design an effective repayment and saving strategy based on a timeframe. For instance, if you’ve calculated that your savings won’t be enough to raise the needed amount at the end of the loan term, you can do side hustles to make extra money. You can even go the extra mile by investing your money to earn returns. Just make sure the investment broker is legit.

3. It reduces your business tax liability.

If you get a car loan for business, you can save money on tax payments because only the interest component of your actual repayment is tax deductible. More of your outgoings can be claimed on tax if the bulk of your regular repayments are interest.

4. You can negotiate the balloon payment.

The balloon payment is typically flexible. You can negotiate with the lender to set your lump sum to a few hundred dollars or more depending on your financial situation and payment capability.

5. You can sell the car to pay off the loan.

If you hold the title to the vehicle, you may have the option to sell it and use the money as the balloon payment. Make sure to discuss this option with your lender as there may be liens and restrictions that could prevent you from selling the car.

Disadvantages

1. You might not have enough money for the balloon payment.

If the lump sum is too high, you might not be able to raise enough money for it. If you can’t provide the balloon payment at the end of the loan term, you will default on your debt and your credit rating will plummet.

2. Your car might be repossessed.

Aside from loan default and a damaged credit score, you may also lose your vehicle if you can’t afford the final payment. This could happen in a non-ownership balloon payment where the lender still owns the vehicle at the end of the loan term and can resell the car. Make sure to discuss ownership balloon payments and non-ownership residuals with your lender to understand what you are agreeing to.

3. You might pay more in interest.

To compensate for the low monthly repayments, you might end up paying the loan for a longer period of time. In the process, you will pay more in interest. Paying this additional interest over your loan term might costs you more than you think.

4. You might end up paying for a car that’s worth significantly less than its price.

Your car’s value will decrease over time. In a few years, you will be paying for a vehicle that’s worth significantly less than the amount you borrowed. Even if you sell the car, the profit still might not be enough to cover the full loan amount.

What Should You Do When the Balloon Payment Is Due?

1. Pay it off.

If you have enough money in the bank or have generated the cash you need, simply pay the lump sum when it comes due. This may not always be feasible, however. It’s usually lack of money that forces you to get a car loan in the first place.

2. Sell your car.

You can always sell your vehicle and use the money to cover the balloon payment. After all, you’ve already used the car for several years. Smart thinking, right? The problem, however, is that your car’s resale value might not be enough for the lump sum. Because of depreciation, your car will worth less. If you’re planning to sell your car after three years or so, avoid several bad habits that depreciate the value of your car faster.

3. Refinance your car loan.

When your balloon payment is due but you don’t have enough money in the bank and your car’s resale value is not enough for the lump sum, you can pay it off by obtaining another loan. This is called a car refinance.

This new loan contract will extend your repayment period to other several years. Because of the extended repayment period, you may end up paying a significant amount in interest. As much as possible, get a car refinancing with an interest rate that’s about the same or lower than when you first borrowed. Also, your credit score is usually taken into consideration when applying for a car refinance. Make sure to pay your debt and bills on time to improve or maintain your good credit score.

If you’re considering a balloon payment car loan, plan for the inevitable lump sum and develop a backup plan in case things don’t work out the way you want them to be.

Positive Lending Solutions has an expert team of brokers that negotiate the best car loan for you. Get a full personalised quote by filling out our Loan Pre-Approval Form or call 1300 722 210 to talk to one of car loan specialists.

See also:

Guide to Finding the Best Car Finance Deals

Large Down Payment vs Low Interest Rates—What's More Important?

Should I Use Savings to Pay Off My Car Loan Early?