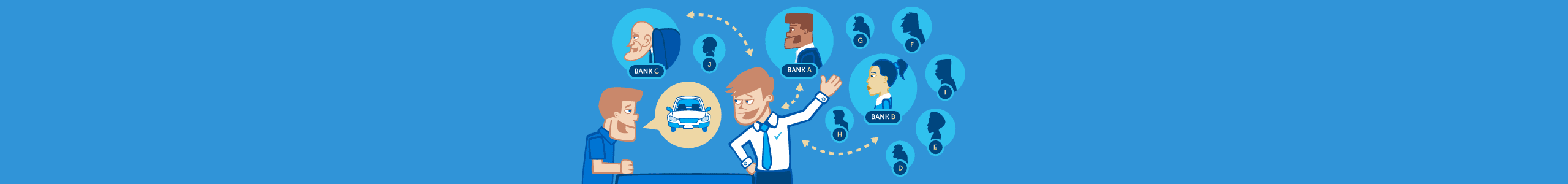

The Positive Process

The vehicle financing process can be a complicated web of confusion for most, we commonly receive a lot of questions on how loan process works. So we’ve created a wonderful roadmap showing the steps in our loan process.

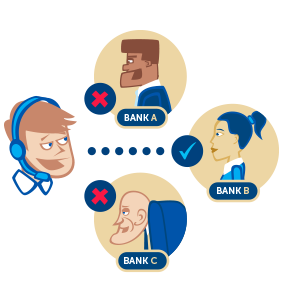

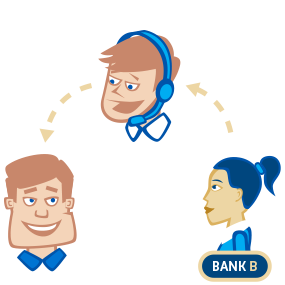

The loan application process varies slightly depending on the type of vehicle you are purchasing. For the below example, we’ve used our most popular car loans to illustrate how we conduct your finance application for you.