How to Buy a Car During the Coronavirus Crisis

The coronavirus pandemic and the preceding lockdown in Australia have put millions of businesses under crisis, including the car industry.

Nevertheless, it remains possible to buy a vehicle during this uncertain time. It is also opportune to finance a vehicle for business or personal use because of the low interest rates and repayment holidays.

Coronavirus and the Car Crisis in Australia

As the threat of infection from coronavirus (or "The Rona" as Aussies are starting to call it) rises, the car industry has seen a steady drop in sales.

- A lessening number of people visit car dealerships and showrooms to shop for a car or inquire about car loan offers. Social distancing has made it challenging for both buyers and salespeople to engage in face-to-face communication.

- Aside from the difficulty of shopping for cars in dealerships and showrooms, the coronavirus pandemic has also affected vehicle launch programs and consumer and business confidence. Car launches, which are supposed to attract many people, have been cancelled following the ban on non-essential indoor gatherings of more than 100 people.

- While there are enough vehicle supplies at the moment, various car-makers around the world have also stopped production. This would eventually impact local stock levels.

All these factors contribute to the slowing traffic in dealerships across all of the global car-makers retailing in Australia. According to FCAI, the automotive industry has 23 consecutive months of negative growth and is now heading towards its lowest annual sales result since the Global Financial Crisis. The sales have also tumbled 10.3 per cent to the end of February. It is now on track to drop below one million units for the first time since 2009.

Lending Support for Businesses

To stimulate demand for new vehicles amid the coronavirus crisis, the Federal Chamber of Automotive Industries (FCAI) has devised incentive proposals.

The Morrison government has also pledged, on top of the billion dollar-worth economic stimulus packages, $80 billion to support the banks in lending to small and medium businesses and $15 billion for smaller and non-bank lenders to also support SMEs.

It is opportune to buy a car amid the Rona crisis for both practical and financial reasons.

Convenience and Social Distancing

- A personal car is a trusty companion in times of emergency. If one needs to buy essential items at the supermarket, get checked in the hospital for flu-like symptoms or for other ailments, or send a child to school, a personal vehicle can also help.

- People who drive their own car can effectively practice social distancing while out and about. Should the need to make trips outside their home arise, avoiding close contact with infected people is easier for those who drive their own vehicle than for those who commute by bus, Uber, or train.

Favourable Deals on Car Purchases

A number of automakers now provide buyers with the option to defer their payments. These include Ford, Nissan, and Hyundai.

With a downturn in sales, salespeople and private car sellers are also more inclined to offer favourable deals.

Interest Rate Cuts and Mortgage Holidays for Small Business Owners

The Federal Reserve Board has cut the interest rates on business and auto loans, making finance more affordable to borrowers with top credit ratings.

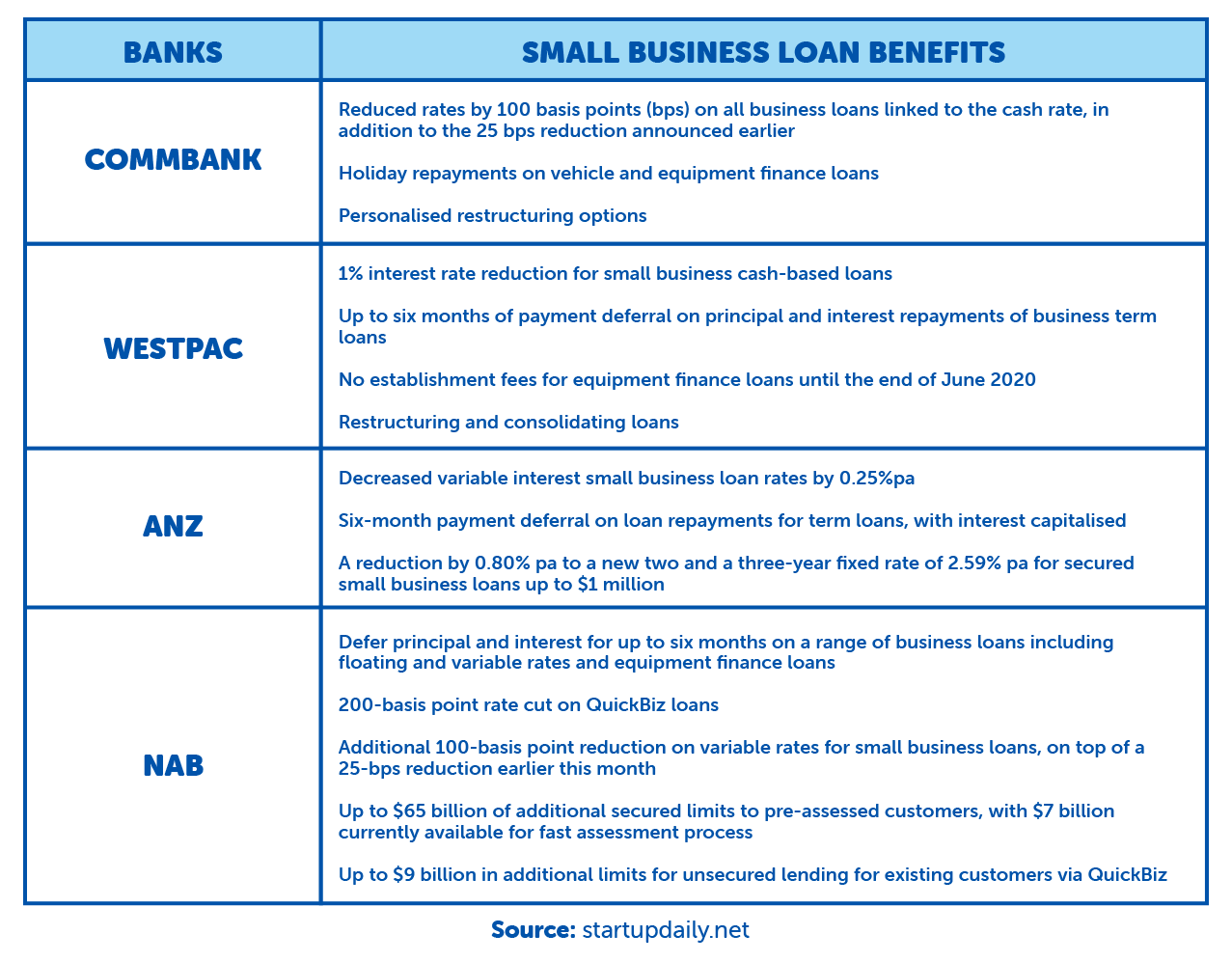

- If you’re using a business loan to buy a new vehicle, you can take advantage of the various lowered interest rates and repayment holidays, especially if you are economically affected by the coronavirus crisis.

- The interest rates for car loans from the banks are now lower compared to previous lending programs. Those who have active car loans and are struggling with their repayments because of income loss can also request to defer their loan repayments for up to six months.

Best Ways to Buy a Car

If you’ve finally decided to buy a car during this uncertain time, here’s how to do it while minimising the risk of coronavirus infection:

Do your car shopping online

Thanks to the Internet, you don’t have to spend days out in car dealerships and showrooms to check out cars and negotiate with different salespeople.

You can search the web for the latest and past-model vehicles, as well as read reviews from industry experts and car enthusiasts. These reviews usually provide you with more information about vehicles, from their features to their driving performance, than many showroom personnel.

Visit websites of automakers and car dealers

These official websites provide a list of new and used models including vehicle history reports that detail service records and other important data.

Use online loan calculators

If you're planning to finance your vehicle purchase, use the online loan calculators that are usually installed on the lenders' websites. These free-to-use tools help you calculate how much you can afford to spend on a car based on monthly payments at a quoted interest rate, as well as help you compare deals from several car lenders.

Negotiate via email, online chat, or phone

There's no need to leave the house to negotiate with salespeople or private car sellers. You can haggle and get a locked-in price via the Internet or phone.

Apply for a car loan through a finance broker

Modern finance brokering companies, like Positive Lending Solutions, match your credit profile and financing needs with the right lender. They also process loan applications online so you don’t have to visit banks or lending companies yourself.

Use a vehicle sourcing service

If you don’t have time to do the car shopping yourself, you can hire a vehicle sourcing service to do it on your behalf. Some companies even provide this service for free, like Positive Lending Solutions, which offers the service for clients who have been approved for a car loan.

“Vehicle sourcing is straightforward. Simply tell us what car you're looking at purchasing, and then we scour the Australian car market for it. We negotiate with the vehicle seller to get you the best price possible. We can also arrange the delivery or you can go and pick up your new car yourself.”

Practice social distancing when conducting a test drive

While you can shop for cars and apply for vehicle finance online, you would still need to be at the dealership (or the car owner’s place if you’re buying a used car) to test drive a vehicle. Fortunately for you, because of the lockdown, the foot traffic in public spaces is now slow. Observing social distancing won’t be that much of a problem.

As you take the test drive:

- Ask the salesperson or the seller to sit in the back seat on the opposite side of the vehicle.

- Use a hand sanitiser compulsively.

- Bring along a few disinfectant wipes and treat all the interior touchpoints of the car before settling in (if allowed). Pay attention to the car keys, steering wheel, door handles, shift lever, window and mirror switches, seat belt fasteners, and the rearview mirror surround.

- Stay away from a coughing or seemingly ill salesperson or private seller.

Request the car to be delivered to your door

You can request for your newly purchased car to be delivered to your address through car delivery services like HelloCars and Vroom.

Disinfect your newly delivered car once again in your garage. Pay attention to the cabin: Disinfect it with at least 70 percent alcohol or good old soap, especially if it is a pre-owned model.

Should You Get a Car Loan Now?

If you believe that buying your own car can help you avoid mingling with many people while making essential trips outside your home and provide a convenient means of transportation for your personal and business needs, this could actually be an advantageous time to do it. Just remember to take a few precautions while you're out car shopping or test driving.

However, if you feel like your employment or business is on shaky ground and you cannot afford the repayment in case you lost your source of income, you may have to wait for a month or two (or after this uncertain time has passed) to commit to a new debt obligation.

See also:

Can You Get Finance Under the Coronavirus Lockdown?

$150k Instant Asset Write-off & How You Can Make The Most Of It

.png)

.png)